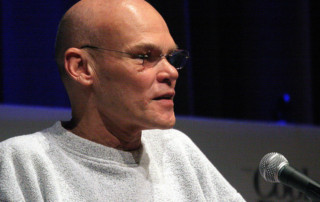

Senator Murray’s Tea Party tactic

In her speech at the Brookings Institution yesterday Senator Patty Murray (D-WA) threatened to allow tax increases on all income taxpayers to take effect January 1 if Republicans refuse to allow tax rates to increase on “the rich” and on successful small business owners.

SEN. MURRAY: So if we can’t get a good deal, a balanced deal that calls on the wealthy to pay their fair share, then I will absolutely continue this debate into 2013 rather than lock in a long-term deal this year that throws middle class families under the bus.

A member of the Senate Democratic leadership, Senator Murray claimed to be speaking for other elected Democrats:

And I think my party, and the American people, will support that.

How is this different from those Tea Party-affiliated and conservative Republicans who last summer threatened to block a legislated debt limit increase unless spending was aggressively cut?

Last summer there was a broad consensus that the policy consequences of not raising the debt limit would be potentially catastrophic. Today there is a similarly broad consensus that allowing all tax rates to increase January 1 would be catastrophic. CBO projects a recession in the first half of 2013 if taxes are allowed to increase and the spending sequester takes effect (another Murray threat if her demands are not met).

CBO: Under those fiscal conditions, which will occur under current law, growth in real (inflation-adjusted) GDP in calendar year 2013 will be just 0.5 percent, CBO expects—with the economy projected to contract at an annual rate of 1.3 percent in the first half of the year and expand at an annual rate of 2.3 percent in the second half. Given the pattern of past recessions as identified by the National Bureau of Economic Research, such a contraction in output in the first half of 2013 would probably be judged to be a recession.

CBO projects about 1.3 million fewer people will be employed next year if Senator Murray’s threat were carried through 2013 (see table 3).

Today Senator Murray’s threat matters only if elected Republicans refuse to agree to her demand to raise taxes on the rich and on successful small business owners. Without this disagreement her threat has no effect. Last summer the conservatives’ threats to block legislation raising the debt limit mattered only because President Obama and Congressional Democrats refused to agree to conservative demands to cut government spending. Had Democrats been willing to agree to the conservatives’ spending cuts, the conservatives’ debt limit threat would have had no effect.

Today Senator Murray or her allies could argue that those refusing to agree to their condition are, in fact, the ones “holding middle class taxes hostage.” Conservative Republicans could have argued the same last summer about the debt limit, that the debt limit increase was in fact held hostage by those refusing to cut spending.

Last summer conservative Republicans argued that the policy damage done by a debt limit increase was being exaggerated. Yesterday Senator Murray did the same about, arguing that allowing income tax increases on everyone to take effect would not be catastrophic. Both the Tea Party and conservative Republican members and Senator Murray argued that the effects of carrying through with their threat were undesirable but worth withstanding if necessary to achieve a more important policy goal.

The Budget Control Act signed into law last sumer increased the debt limit and cut spending, although not deeply enough to satisfy many of the conservatives who issued the threat. At the time I wrote their threat tactic was “undesirable, necessary, and effective.” Those wanting to cut spending achieved a medium-sized policy win, at a significant political cost to the Republican brand. Senator Murray may surmise that she will not be treated as harshly by the press as were conservative Republicans last year, despite her use of the same tactic and her threat to produce a similarly damaging economic outcome.

Unless her demand to raise taxes is met, Senator Murray is threatening to cause a recession in the first half of 2013. Her threat should be treated the same as the parallel threat made by some Republicans last summer.

(photo credit: captured from Brookings Institution video)

Why not expand Medicaid?

Correction: I got the match rates in my example wrong because I ignored the second law which overrode the ACA on the match rates. The text below is now accurate. My error doesn’t change any of my substantive arguments.

Last week former Michigan Governor Jennifer Granholm (D) argued that any Governor who rejected the Affordable Care Act’s new Medicaid expansion was either stupid or evil. This is a common refrain from the law’s defenders, that only an irrational or uncaring Governor would reject the ACA’s new Medicaid subsidies to provide health insurance to poor adults without kids.

This question is now relevant thanks to the Supreme Court’s recent ruling. The Roberts Court ruled that the federal government may not deny the federal share of funds for a state’s existing Medicaid program if that state refuses to avail itself of the new subsidies offered for expanding program eligibility. In the wake of this ruling several Governors have said they will not, or may not, expand their Medicaid programs, notwithstanding the ACA’s offer of generous matching federal funds.

How generous? Under the ACA the Feds will pay all benefit costs for this new population through 2016, and then phase down to a 90 percent federal share from 2020 on. That compares to an average federal share of 57 cents of each dollar spent on Medicaid benefits for existing populations. The exact federal share varies by state and ranges from 50 cents federal to 78 cents federal for basic Medicaid benefits.

New Jersey Governor Chris Christie might say, “I have to pay 50 cents of state money for each Medicaid dollar spent in New York. If I expand my Medicaid program to these poor childless adults, I’ll have to pay ten cents of state money for each Medicaid dollar spent on them after the first few years.” From a state’s perpective, the decision to expand Medicaid means higher state expenditures but at a drastically reduced cost in state funds per new enrollee. Adding new people still costs you scarce state funds, but these new enrollees would be cheaper to the state than the people already in your program.

Why, then, would a Governor reject such a generous offer? She can provide health insurance for poor residents of her state for no cost in the first two years and at an extremely reduced cost after that. If a Governor refuses, ACA defenders argue she will be leaving enormous amounts of federal money “on the table.” Governor Granholm points out that states already subsidize hospitals to cover some of the costs of the uncompensated care delivered to these poor uninsured people. And since in most cases Medicaid pays providers low payment rates, adding them to Medicaid is a relatively inexpensive way to provide them with health insurance.

Charles Blahous was first to publicly explain how the Court’s decision could make the ACA’s finances untenable. He examined the incentive the Court’s decision would have for Governors to abandon Medicaid expansions in favor of federally-funded subsidies through state exchanges.

Let’s briefly review seven additional challenges to the case made by advocates for Medicaid expansion under the ACA. The bar is low: we don’t have to prove that a Governor should not expand Medicaid, only that one can make this decision without being irrational or evil. Thanks to a knowledgeable friend for helping me with these.

- “Leaving federal money on the table” looks at the problem backwards. The law does not offer states free money without conditions, it reduces the price to the state of covering these new people. A state must still find the funds to cover its 10 percent of the new Medicaid costs. While that’s a tiny fraction of the total new costs, Medicaid is a huge program and many states are already in dire financial condition. If a state can’t afford its share it doesn’t matter how much the Feds are offering. A Governor must look at her budget and prioritize the state resources at her disposal. Medicaid spending is one of the two largest components of most state budgets. It is reasonable for a Governor to conclude she would rather use her limited resources for other needs (education, emergency services, public infrastructure) than to expand her state’s obligations for its biggest and fastest-growing entitlement.

- A smart Governor recognizes that a commitment to expand Medicaid eligibility is likely to be permanent, so she may be risk averse. It is quite difficult to cut off eligibility for a group of people once it’s been granted. Our Governor must also consider political and legislative risk from Washington. Sure, the Feds are offering to pay all benefit costs for the first three years, and most costs after that. But the law might be repealed in 2013. Even if it’s not, Congress could cut federal match rates in the future to address federal spending pressures. In his budget President Obama has proposed to “align” match rates in Medicaid and CHIP, code for cutting CHIP match rates. A federal “Grand Bargain” fiscal negotiation would certainly consider cutting federal match rates for Medicaid and CHIP. In any of these scenarios the state and our Governor bear the downside fiscal risk.

- A Governor must also worry about creeping federal requirements for this new population. States have some flexibility designing benefit packages for their Medicaid populations and a lot of flexibility in designing insurance structures and setting payment rates. The Feds, however, are looking at this new group of people as part of their “ACA eligibility expansions,” along with others who will buy subsidized insurance through state exchanges. What happens, then, if the Feds want to impose new requirements on the exchanges, and then require states to do the same with their Medicaid programs? The Feds have a history of doing this in Medicaid.

- There are hidden costs to this expansion. Any time a program like Medicaid is expanded there is a woodwork effect. Some mothers and their kids who were eligible for Medicaid before the ACA, but who had not enrolled, would be drawn to enroll with the increased publicity to enroll newly eligible poor childless adults. If your focus is on enrolling poor people in Medicaid this is a good thing. It is also an increased cost to the state budget, especially since these mothers and their kids are not eligible for the higher federal match rate in the ACA. A Governor considering whether to expand her program must include these additional costs in her decision, even though they don’t directly impact the target population. A state also bears the administrative expenses and challenges of expanding its program.

- Adding new people increases government spending and total spending on health care. Yes, those who lack prepaid health insurance impose uncompensated care costs on hospitals. Yes, the states pick up some of these costs through subsidies to those hospitals. Both would be reduced if more people had prepaid health insurance. But while expanded Medicaid eligibility means more and better medical care for those who were previously uninsured, it comes at an added cost to the government (Feds + States). There is no free lunch here, only a reduced price lunch. More people X more medical care = more spending.

- A Governor creates negotiating leverage with the Feds by saying no, even temporarily. The Feds and States are constantly engaged in negotiations over funding and rules for Medicaid and CHIP. Governors know that the Obama Administration needs them to expand their Medicaid populations for PPACA to approach its coverage goals. Congress wrote the law with an effective mandate on states to cover these people. The Court inverted that power dynamic, and any Governor who says no to an expansion gains leverage for more federal funds or flexibility in other areas.

-

If it’s such a good deal why did the Feds mandate it? There’s a parallel here with the individual mandate and accompanying subsidies. The law’s authors knew that subsidies would encourage some individuals and some states to buy health insurance or expand their Medicaid programs. They knew that others would not take advantage of these subsidies, so they mandated participation with penalties for noncompliance. The individual mandate and penalty tax survived the Court challenges while those imposed on states did not. It is reasonable to assume that, without the mandate, some states will now choose not to expand their biggest (or second-biggest) state spending program any further.

When the ACA was enacted in 2010 CBO estimated that the Medicaid expansions would result in 17 million more Medicaid enrollees by 2016. The Supreme Court’s ruling and subsequent decisions by Governors should reduce that. We will see by how much if the law is not repealed next year.

(photo credit: White House photo by Pete Souza)

Wall Street Journal op-ed

Here’s my op-ed in today’s Wall Street Journal: A Strategy to Undo Obamacare.

Who will pay the ObamaCare uninsured tax?

Now that the Supreme Court has upheld the constitutionality of the Affordable Care Act, who will pay the tax for not having health insurance?

CBO answered this in April 2010. They projected that in 2016, when the mandate is in effect and the tax is fully phased in, there will still be 21 million uninsured people. This belies the advertised “universal coverage” label.

Oversimplifying a bit, for most people the tax in 2016 will be $750 per adult and $375 per kid.

But while 21 million people will be uninsured, CBO said “the majority of them will not be subject to penalty.” That’s an understatement.

You won’t have to pay the tax if:

- you’re not in the U.S. legally;

- you’re in prison;

- you’re poor (measured two different ways);

- you’re a member of an Indian tribe;

- you’re in a period of being uninsured that’s less than three months long;

- your religion forbids getting health insurance; or

- you get a waiver from HHS.

Given HHS’ behavior in handing out waivers since the law was enacted, this waiver authority bears further observation and scrutiny.

In addition, some who are legally required to pay the tax will not do so. CBO/JCT therefore assumes a certain amount of noncompliance (aka cheating).

This gets CBO’s 21 million uninsured in 2016 down dramatically to 3.9 million who will be both uninsured and pay the tax. Total U.S. population in 2016 will be about 327 million. This means that, in 2016:

- almost 94 out of every 100 people will have health insurance in some form;

- five out of every 100 will be uninsured and pay no tax;

- a bit more than one out of every 100 will be uninsured and pay a tax to the government.

If I’m that one person out of 100, I’m going to be pretty ticked off at those five. All six of us are uninsured but I’m the only one of the six who has to pay higher taxes.

CBO also estimated the income levels of those 3.9 million uninsured who will pay higher taxes. More than 3/4 of them are not rich.

| Income relative to federal poverty line |

# of people paying tax |

Income range (single) |

Income range |

| Below poverty | 400,000 | $0 – 11,800 | $0 – 24,000 |

| 100% to 200% | 600,000 | $11,800 – 23,600 | $24K – $48K |

| 200% to 300% | 800,000 | $23,600 – 35,400 | $48K – $72K |

| 300% – 400% | 700,000 | $35,400 – 47,200 | $72K – $96K |

| 400% – 500% | 500,000 | $47,200 – 59,000 | $96K – $120K |

| > 500% | 900,000 | > $59,000 | >$120K |

| Total | 3,900,000 |

Reading the first line of this table, CBO says that under this law in 2016 there will be 400,000 people below the poverty line who will be uninsured and pay the tax. (More will be required to do so — this is the number who will comply with the law.) Singles in that income range will have annual income less than $11,800, and families of four in that range will have annual income less than $24,000. These are 400,000 poor uninsured people who will be forced to pay higher taxes.

Similarly, if we add up the rows up to 500% of poverty, we see that under this law there will, in 2016, be three million people with incomes less than $59,000 (singles) or $120,000 (families of four) who will be uninsured and have to pay the tax. These three million people are not rich, they will be uninsured, and they will be required to pay higher taxes. The tax increases on these people, as well as some fraction of those in the “>500%” category, clearly violate the President’s pledge not to raise taxes on anyone earning less than $250K.

Jim Capretta points out that these estimates may be low. In 2010 CBO assumed a mandate enforced by a penalty for noncompliance. Before today’s ruling, the law created both a legal and a moral obligation to buy health insurance. If you didn’t buy insurance, you would be violating the law and have to pay a penalty to the IRS. Some people would buy health insurance even though financially it would make more sense for them to just pay the penalty, because they didn’t want to be perceived as breaking the law and paying a penalty.

Chief Justice Roberts’ opinion converts the mandate+penalty into a “pay or play” choice model by turning the penalty into a tax you can choose to pay, without moral opprobrium, rather than buying health insurance. By removing the “should” implication of the mandate, the Roberts opinion should increase CBO’s estimate of how many people will go uninsured and pay the tax instead.

How to avoid shafting future retirees & creating another bailout

Congress will soon vote on a final version of a two-year highway spending bill. Press reports suggest the just-concluded agreement includes a “pension funding stabilization” provision from the Senate version of the bill. This means that any Member of Congress who votes for the final bill will be (a) shafting some future retirees in defined benefit pension plans and (b) increasing the risk of a future taxpayer bailout of a government-run corporation that insures pension plans. Congress can avoid both these bad things simply by removing this provision from the final version of the bill.

In a defined benefit (DB) pension plan firm managers set aside cash now to pay benefits later. The firm then invests that cash and hopes that future cash contributions, plus the investment returns on the assets, will be sufficient to pay these benefit promises in full. It’s a bit tricky to project future pension benefits, but the principal challenge is estimating the rate of return on investing the assets in the pension fund. If a firm manager assumes a high rate of return, then he doesn’t need to set aside a lot of cash now to pay future benefits and he can use that cash for other purposes now.

Of course if the investment returns fall short of his overly optimistic assumptions then the pension plan will be underfunded. There won’t be enough in the plan to pay future benefits. That becomes a huge problem if the firm goes bankrupt. Then the firm hands the plan assets and benefit promises over to a government-run insurance company, the Pension Benefit Guaranty Corporation (PBGC), whose sole purpose is to insure DB pension plans of firms that go bankrupt.

PBGC then takes those (insufficient) pension fund assets and distributes them among the firm’s retirees. Since the plan is underfunded, retirees have to take a “haircut” on their pension benefits. Someone who spent decades of his life working for a firm finds, in retirement, that the pension promise upon which he has relied is now broken.

If the assets are insufficient to pay full benefits, PBGC will fill in the gap in a retiree’s pension promise, but only up to a specified amount (about $56K/year in 2012). Above that the retiree is shafted. That is problem #1. Firm managers benefit while they are underfunding the pension plan. They have more cash on hand to use for other purposes: investing in plant and equipment, hiring workers or paying them more, paying themselves more, or paying dividends to the firm’s owners. Future retirees lose by bearing some of the risk of the firm going bankrupt and then short-changing the promised pension benefits.

Problem #2 is that the PBGC insurance plan for DB plans is also underfunded. Firms with DB pension plans must pay premiums to PBGC, and those premiums are set by statute. These same firm managers and their lobbyists persuade Congress not to raise the premiums, creating the PBGC underfunding problem.

What happens, then, if in the future a firm with a DB plan goes bankrupt, and PBGC doesn’t have the money to fill in the benefit gaps as it is required to do? Current law provides no answer, leaving two possibilities:

- That firm’s retirees with pensions below the cap ($56K today) will not be paid full benefits;

- Or more likely, there will be intense pressure on Congress to bail out PBGC so these retirees’ benefits can be paid by taxpayers.

To their credit, the new highway bill negotiators increased legislated PBGC premiums, but they allowed firms to underfund their plans more. While future retirees bear some of the risk of today’s underfunding, taxpayers bear the rest of it.

Here is how the scam works:

- Some irresponsible firm managers contribute to their DB pension plan the minimum amount required by law, even when their pension plan is underfunded.

- When asked about the underfunding, they say “We’re doing what the law requires,” even though the law does not require them to fully fund the promises they have previously made to their employees.

- Whenever they can, these same firms lobby Congress to increase the investment return they are allowed to assume, making their pension plan look healthier than it actually is and requiring them to contribute less cash.

- If Congress won’t change the allowed investment assumptions, then these firms lobby for legislated “contribution relief” that allows them to reduce or delay the rate at which they contribute cash to reduce their plan’s underfunding.

- They also lobby Congress not to raise the premiums they must pay to PBGC, even though PBGC doesn’t have enough cash on hand to cover its contingencies.

- If (when) one of these firms goes bankrupt, firm managers “dump” the pension plan on PBGC and wash their hands of it.

- Whatever underfunding exists in the plan falls on retirees above the PBGC cap, who see their promised pension benefits cut.

- If (when) someday in the future PBGC doesn’t have enough cash on hand to fill in benefits up to the cap, then firm managers and their retirees will demand a taxpayer bailout from Congress.

- At that point Congress will have to choose between (a) shafting taxpayers and (b) allowing the government to default on its promise to backup the pension promises of these low and moderate-wage retirees (after their former employer has already failed to fulfill their original promise).

Now for the kicker: in many cases the labor leaders who represent the firms’ employees cooperate in this effort. Management and labor leaders team up, both to underfund the DB pension plan and to lobby Congress to allow them to do so. This frees up immediate cash in the firm, which management and labor then wrestle over. When they do this, labor leaders are prioritizing current wages and current benefits over future pension benefits, and at the same time shifting some of the risk associated with paying those future pension benefits to taxpayers.

The firm managers lobby Republicans in Congress and the labor leaders lobby Democrats. “Give us pension funding relief,” they argue. Members of Congress and staff, who are used to management and labor doing battle, are happy to see that at least on this issue they agree. There is then a strong bipartisan push for a legislative “fix” for pension funding “relief” which allows the continued underfunding of both the DB plans and the PBGC to continue.

No one lobbies on behalf of future retirees who face increased risk of having their pension benefits cut when their employer goes bankrupt. No one lobbies on behalf of the taxpayer who faces increased risk of paying for a future PBGC bailout.

The details and justification of the particular proposed legislative change, including the one now in play, are unimportant. This is a world of actuarial assumptions and accounting conventions that is at best complex and at worst obtuse and intentionally obfuscated by those trying to behave irresponsibly. The big picture is always the same: management and labor team up to change the legislated rules to allow the firm to pay less cash now to an underfunded DB pension plan. Future retirees and taxpayers bear the increased risk and cost of Congress allowing irresponsible behavior now by firm managers and labor leaders.

The lobbyists play a clever game depending on the financial environment. When financial markets are performing well they say “Look at what great investment returns we have been getting! Congress should change the law to allow us to assume these great returns continue, meaning our plans are no longer underfunded and we don’t have to contribute any more cash.”

When markets perform poorly, the lobbyists cry poverty. “Our firms are hurting. Yes, our investment returns have been poor, and yes, our pension plan is severely underfunded. But every dollar we put into our underfunded pension plan is a dollar we cannot spend to hire a worker or invest in plant and equipment. Congress should change the law to allow us to contribute less cash to our pension plans in the short run. Then when the economy has come back we’ll have more cash on hand to fill in the underfunding.”

In the past the preferred tactic was to legislatively change the rules for calculating the amount of underfunding. This is legislated lying — firms were allowed to make unreasonable assumptions and falsely show that their plans are not underfunded. Based on these spurious calculations they then had to contribute less cash. It also allowed them to tell their employees, “Based on the government’s rules for calculating pension plan funding, your plan is healthy.”

In 2006 the Bush Administration worked with a few responsible Members of Congress (most notably Speaker Boehner and Senators Baucus and Grassley) to change the law to bring more honest accounting to DB pension plans. We were largely but not completely successful. It is harder to lie about your plan’s underfunding than it used to be.

The pension provision in the Senate version of the highway bill does not change the way pensions are measured. It instead changes the method for calculating the required minimum cash contribution to a pension plan. If this becomes law it will allow those firms with the most underfunded pension plans to contribute even less cash toward closing their funding gaps. Congress will once again be complicit in allowing firm and labor leaders to violate promises made to workers.

Everyone says they hate taxpayer bailouts. The best way to stop taxpayer bailouts is not to block the bailout after the catastrophe has occurred, it’s to avoid creating the catastrophe in the first place. By stripping this provision (which was Section 40312 of the Senate bill) from the final highway bill, Congress can avoid making it easier for irresponsible firm managers and labor leaders to shaft future retirees. They can also avoid increasing the risk of a future taxpayer bailout of PBGC.

Some day in the future firms with defined benefit pension plans will go bankrupt, their retirees will be shafted, and Congress will be pressured to make taxpayers finance a PBGC bailout. Members of Congress will give angry speeches and everyone will ask how this could have happened. The answer will be in part that Members of Congress voted for and the President signed this highway bill containing this “pension funding stabilization provision.”

Congress, you have been warned.

It’s not just the economy, stupid

What do these four things have in common?

- The short-term path of the U.S. economy;

- The Supreme Court’s upcoming decisions on the Affordable Care Act;

- The economic and financial mess in Europe;

- A possible Israeli attack on Iran and whatever Iranian response that provokes.

I see four commonalities:

- Each has a moderate chance of going wrong before Election Day;

- The short-term domestic economic policy effects of each are significant;

- Each could change the agenda and course of the U.S. election;

- Each is largely outside the President’s control.

James Carville’s line from the 1992 campaign, “The economy, stupid,” may be too narrow this year. Yes, the domestic economy is the most important subject for the election. But the U.S. economy may not be the only subject this fall, and if we drill down further we can find complexities beyond the simplistic political analysis of “Economy bad, incumbent loses.” President Obama’s economic campaign challenge is multidimensional.

- The recovery is weak and recent data make it hard to claim things are getting better. The level is bad (8.2% unemployment) and the direction and rate of change are nothing to brag about. Today the Fed knocked half a percentage point off their projected GDP growth rates for the remainder of 2012. The President and his team made a tactical political error by betting on a continuing positive trend, hoping they’d be able to argue “Things may be bad but they’re getting better because of our policies.” This backfired with the last jobs report but could change again in the next four months.

- Downside macro risks are more significant than upside risks. Europe teeters.

- Stimulus is behind us. The Court may overturn health care reform next week. If it does this leaves Dodd-Frank as the only lasting major economic policy accomplishment of the President’s term.

- Stimulus and health care are also unpopular.

- Other than raising taxes on the rich and spending a few tens of billions of dollars more, the President is not proposing a significant domestic economic agenda for the second term. He’s saying a lot but has few big policy proposals and nothing to address our medium-term fiscal challenge.

- He also doesn’t have a good answer for how to accelerate short-term economic growth other than “Be patient.”

The monthly jobs and GDP data are the most important data points affecting the choice this November, but they are not the only ones. It’s not just the economy.

(photo credit: Aaron Webb)

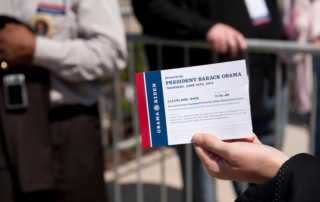

Hello, Cleveland!

Friday I posted a detailed outline of the economic campaign speech President Obama gave in Cleveland. Today I’ll explain five things he did in the speech. One speech isn’t that important, but I’ll be watching over the next five months to see which of these develop into campaign themes.

1. President Obama blames Republican theory for the financial crisis, recession, and slow recovery and links Governor Romney’s policies to that “failed experiment.”

In the past President Obama has harped on the problems he “inherited” and blamed President Bush for the financial crisis, ensuing recession, and even the slow recovery. Similarly, the Obama campaign is attacking Governor Romney’s experience and record, both at Bain and as Governor.

In this speech he instead attacks “Republican theories” and “the failed experiment” of the previous decade. He links Governor Romney to those policies and

President Obama’s flawed syllogism works like this:

- Romney policy X was tried during the Bush Administration. It is part of a failed Republican theory.

- Republican theory caused the financial crisis, recession, and slow recovery.

- Governor Romney’s policy on X may cause a repeat of the financial crisis and recession.

2. President Obama shifts his message from anti-rich to pro-middle class.

President Obama’s last big economic speech was December 6th in Osawatomie, Kansas. In that speech and his State of the Union address he defined inequality, in particular the more rapid income growth of the rich, as the top economic policy problem. The rich are getting richer, he argued, that’s a big problem, and it’s hurting the middle class in a bunch of ways. Those speeches was heavy on the anti-rich rhetoric.

The rich get only brief mentions in the Cleveland speech. Now the President is framing the choice as “Whose plan will help the middle class more?” He refers to the rich only when he frames Governor Romney’s policies. I want to help the middle class, he argues, while Governor Romney wants to help his rich friends.

It is not news to label a Republican candidate as wanting to help the rich, nor for a politician to tailor his message to helping the middle class. It is news when the President’s top policy priority has almost vanished from his message six months later.

3. He barely mentions deficits & debt, entitlement spending, European financial crisis, trade, Affordable Care Act, stimulus, and Dodd/Frank.

What he did not highlight is important. President Obama is campaigning on hiring more teachers and cops, building better solar panels, and fixing more potholes. Three of those four are important policy priorities for a mayor. If he doesn’t talk about the biggest economic problems the Nation faces and doesn’t talk much about his policy accomplishments so far, he is leaving a lot of subject matter off the table.

4. He tests a tagline: “Education. Energy. Innovation. Investment.”

In 1996 President Clinton and Democrats bludgeoned Bob Dole and Republicans with a six word mantra: “Medicare, Medicaid, Education and the Environment.” Democrats were not saying what they would do with those subject, just signaling their policy priorities to voters. It worked.

President Obama may be testing his own tagline with these four words from the Cleveland speech:

Education. Energy. Innovation. Investment.

If that exact phrase starts popping up in the President’s messaging, then Republicans better watch out. It worked before.

5. He frames the Romney option as a radical shrinking of government and the Obama option as a continuation of the historic practice of a mixed economy.

It appears President Obama wants to frame this choice across multiple dimensions:

| Romney | Obama |

| radical change | safe, incremental changes |

| shrink government to near zero | maintain government with a few small expansions in needed areas |

| Wild West | balance of government and markets |

This framing and the entire speech are aimed at a centrist audience. Both dimensions are important: he is describing himself as an incrementalalist and his opponent as part of a group of radicals who will destroy government and cause grave economic harm. If President Obama’s past and planned future expansions of government are seen as radical, or if Republican policies are seen as either incremental or a return to an acceptable pre-Obama state, then the President’s framing will fail.

President Obama’s Cleveland economy speech – detailed outline

This is the second of two posts. Here is the first, a much shorter high-level version of the outline contained here.

This is my attempt to build a detailed outline of the economic speech President Obama gave in Cleveland yesterday (watch it).

I used his language in some parts, but in many parts these are his concepts expressed in my words, I hope to provide more clarity.

It won’t surprise regular readers that I disagree with much of this. I have tried not to let that cloud this summary.

Detailed outline of President Obama’s Remarks on the Economy

Cuyahoga Community College

Cleveland, Ohio

Thursday, June 14, 2012

I. Big choice — two paths

A. Choice / two fundamentally different visions.

B. Choice and debate are not about whether we need to grow faster, but instead about how to:

1. Create strong, sustained growth;

2. Pay down our long-term debt;

3. Generate good, middle class jobs so people can have confidence that if they work hard, they can get ahead.

C. Big decisions. Not new challenges. Problems more than a decade in the making.

D. Being held back by a stalemate over two different paths for our country. Election should is about resolving this stalemate.

II. Define & blame Republican theory for bad stuff.

A. Long before 2008 the basic bargain had begun to erode

B. Define Republican theory: cut taxes, no regs, market solves everything

C. Results of Republican theory: worked well for the rich, but prosperity never trickled down to the middle class.

III. Be patient.

A. Not your normal recession.

B. It has typically taken countries up to 10 years to recover from financial crises of this magnitude.

C. We’re in better shape than Europe.

IV. Take credit for the good stuff

A. We acted fast. My policies are working.

B. We’re recovering from:

1. Financial crisis of 2008;

2. A decade of middle class falling behind;

3. Erosion of basic bargain over decade[s?]

V. Romney wants to repeat the failed experiment of the last decade.

A. We implemented Republican theory last decade:

1. Best way to grow the economy is from the top down;

2. Eliminate most regulations;

3. Cut taxes by trillions of dollars;

4. Strip down government to national security and a few other basic functions.

B. This failed theory created the fiscal problems we face now and the financial crisis that caused this weak economy.

C. Romney wants to return to and repeat this failed theory.

VI. Romney’s plan is bad for the middle class.

A. Keep Bush tax cuts in place and add another $5T in tax cuts on top of that.

1. 70% of those will go to >$200K/year, and >$1M/year will get an average tax cut of about 25%

B. Cut valuable government programs: student loans, Head Start, health research and scientific grants.

C. Eliminate health insurance for 33m (repeal ACA) + 19m more (Medicaid cuts).

D. Scale back or eliminate tax breaks that help middle class families: health care, college, retirement, homeownership.

E. Repeat of failed top-down growth theory.

VII. My plan is an economy built from a growing middle class. Race to the top.

A. Education;

B. Energy;

C. Innovation;

D. Investment;

E. Tax code based on American job creation and balanced deficit reduction.

VIII. I’m a centrist, look at my record.

A. I have cut taxes.

B. Fewer regulations than Bush in first three years.

C. Signed into law $2T of spending cuts.

D. Deficit reduction plan to slow health cost growth, not shift costs to seniors.

E. Domestic discretionary spending lowest share of GDP in nearly 60 years.

IX. I’m for keeping the American tradition of bipartisan government involvement in the economy.

A. Government is not the answer to all our problems, and I’m not proposing government run everything.

B. Romney and Republicans want to return us to no rules and unregulated market free-for-all.

C. America has succeeded not by telling everyone to fend for themselves, but by all of us pitching in, all of us pulling our own weight. That’s what I’m for.

I hope you find this useful.

(photo credit: Obama campaign)

President Obama’s Cleveland economy speech – high-level outline

This is the first of two posts.

Here is my attempt to outline the meaty 53 minute economic speech President Obama gave yesterday in Cleveland. I built this outline to help myself analyze the speech, then realized that others might find it useful. While it is true that little of the substance was new, this is nevertheless a serious policy speech that makes what the President and his advisors think is the economic part of their best case for reelection. I will take it seriously and recommend you do so as well — this isn’t just another blow-off stump speech. This is the theory of the economic case the way the President wants you to see it.

If you’re a student of economic policy I recommend you watch or read the whole speech. No summary or analysis can substitute for the candidate’s own words and presentation.

Here is my plan of attack: summarize first; then explain; then respond. Today is just the first step, the summary.

In some cases i use the President’s words, but I’m often using my own more colloquial language to express his arguments more clearly if I can. So in some cases these are his thoughts (I think) in my words. I have done my level best to capture his arguments in their most effective and convincing form, especially when I disagree with them. I will express my disagreements another time.

This post contains just the highest level outline. The next post contains a much more detailed outline. I recommend you skim this one, then read that one.

High level outline of President Obama’s Remarks on the Economy

Cuyahoga Community College

Cleveland, Ohio

Thursday, June 14, 2012

I. Big and fundamental choice — two paths.

II. Define & blame Republican theory for bad stuff.

III. Be patient.

IV. Take credit for progress / the good stuff.

V. Romney wants to repeat the failed experiment of the last decade.

VI. Romney’s plan is bad for the middle class.

VII. My plan is an economy built from a growing middle class. Race to the top.

VIII. I’m a centrist, look at my record.

IX. I am for keeping the American tradition of bipartisan government involvement in the economy.

That’s the short, high-level outline. Here is the detailed version.

I hope you find this useful.

(photo credit: Obama campaign)

Campaign finance disclosures

Since the next five months of policy discussion will be dominated by the election I think it makes sense to disclose my campaign contributions.

In this election cycle I have donated to the following campaigns:

- Mitt Romney for President;

- Paul Ryan for the House;

- Rob Portman for Senate; and

- Ted Cruz for Senate.

I am not “an advisor to” or “affiliated with” these campaigns or any others. And my financial support for these candidates does not mean that I agree with everything they say. I will sometimes write things that are consistent with the policies they advocate. I will also criticize or disagree with them when I think it’s important to do so.

If I contribute to other campaigns I will disclose that here as well.