Understanding the Kennedy health care bill

Over the weekend a draft of Senator Kennedy’s (D-MA) health care bill leaked. After playing with Adobe Acrobat, here is the text of the draft Kennedy bill as a text file (173 K), and as a single Acrobat file (3.4 MB). Update: I fixed the broken link to the PDF. Unlike the leaked version, both of these are searchable.

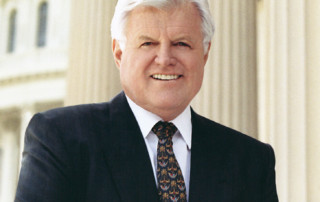

Calling it the “Kennedy” bill is something of an overstatement. Senator Kennedy chairs the Senate Health, Education, Labor, and Pensions committee, and his staff wrote the draft. By all reports, however, Chairman Kennedy’s health is preventing him from being heavily involved in the drafting. Senator Reid has designated Senator Chris Dodd (D-CT) to supervise the process, but as best I can tell, it’s really the Kennedy committee staff who are making most of the key decisions. For now I will call it the Kennedy-Dodd bill.

As the committee staff emphasized to the press after the leak, this is an interim draft. I assume things will move around over the next several weeks as discussions among Senators and their staffs continue. This is therefore far from a final product, but it provides a useful insight into current thinking among some key Senate Democrats.

Update: I now have a three-page outline of the House Democrats’ health care bill. I have a new post which contains all of the content below, and compares it to the House bill. If you read the new post, you’ll get two for the price of one: Understanding the House Democrats’ [and Kennedy-Dodd] health care bill[s].

Here are 15 things to know about the draft Kennedy-Dodd health bill.

- The Kennedy-Dodd bill would create an individual mandate requiring you to buy a “qualified” health insurance plan, as defined by the government. If you don’t have “qualified” health insurance for a given month, you will pay a new Federal tax. Incredibly, the amount and structure of this new tax is left to the discretion of the Secretaries of Treasury and Health and Human Services (HHS), whose only guidance is “to establish the minimum practicable amount that can accomplish the goal of enhancing participation in qualifying coverage (as so defined).” The new Medical Advisory Council (see #3D) could exempt classes of people from this new tax. To avoid this tax, you would have to report your health insurance information for each month of the prior year to the Secretary of HHS, […]