At that Manhattan fundraiser last night President Obama repeated one of his more frequent recent economic lines:

Over the last five years, our economy has recovered faster and stronger from the worst financial crisis and economic crisis since the Great Depression, better than any other developed country on Earth.

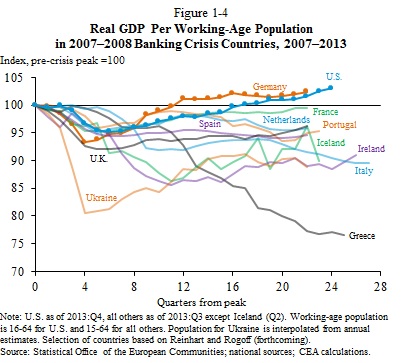

President Obama’s is drawing on the Economic Report of the President released by his Council of Economic Advisers on Monday. Here is the relevant chart, showing the U.S. at a higher relative GDP level than the major European economies, with 2007 as the starting point for the comparison.

Here is the CEA’s accompanying text:

<

blockquote>

(Technical note: “GDP per working-age population” is weird. I wonder what this same comparison with the more conventional “GDP per capita” looks like.)

This provokes three responses.

- Apparently we’re supposed to feel good that the U.S. economy has grown more rapidly than the major European economies. But Europe had a second financial crisis during this time period, one which might still not be over! So the U.S. economy, recovering from one severe financial crisis in the past six years, is performing better than the European economies which have suffered two crises during that same time? Talk about setting a low bar.

-

While a relative comparison might in theory be interesting, it’s not very useful. We should care about how the American economy is doing in absolute terms, and relative to the potential of the U.S. economy. Is the U.S. economy growing as fast as it possibly can? How big of an output and employment gap do we have to close? (Answer: we’re about 6 million jobs short.) If Europe were to go into recession the relative U.S. position would be even stronger, but surely that wouldn’t be a good thing, right? We should want the U.S. and Europe both to grow faster, even if that were to mean a smaller relative advantage for the U.S., yes? Greater relative growth doesn’t teach us much that we can use.

-

The conclusion that “We’re growing faster than Europe so therefore our policies worked” makes no sense to me. And I write this as someone who helped enact and implement some of those U.S. policies (including TARP, the money market mutual fund guarantees, and the first tranche of auto loans). I think some of these policies worked as desired and helped end the financial crisis and make the ensuing recession shallower. I differ with Team Obama on how much the fiscal stimulus in particular contributed to those positive growth effects, and whether the additional growth from fiscal stimulus was worth the added debt costs. But whatever conclusion you reach about the growth benefits of any of those policies, you can’t get there from comparing the recent U.S. growth path to that of Europe. There are way too many other things going on, both in the U.S. and especially in Europe with its two crises, for anyone to be able to isolate the effects of just the U.S.-specific policies. If you want to argue that the U.S. policies worked as intended, you need to find another way to make the case.

I think the President’s statement, that the U.S. economy has recovered more rapidly than other major developing economies, is technically correct. But it’s a sad thing to boast about, it’s not a meaningful measure, it’s not the standard we should use, and it doesn’t support the argument that U.S. policies made a major difference in averting a substantially worse outcome.