I want to propose a four-part test for measuring any particular bill on health care cost control.

|

short run |

long run |

|

| Federal deficit |

1 |

2 |

| Government health care spending |

X |

3 |

| Private health care spending |

X |

4 |

In each case, I will define the test so that “yes” is a good outcome:

Test 1: The bill does not increase the federal deficit in the short run.

Test 2: The bill significantly reduces the federal deficit in the long run.

Test 3: The bill significantly slows the growth of government health care spending in the long run.

Test 4: The bill significantly slows the growth of private health care spending in the long run.

I believe our Nation’s long-term fiscal problems, and the problems resulting from the growth of per capita health care spending, are higher priorities to solve than reducing the number of uninsured Americans now. I would rather solve America’s health care cost problems of the future than expand government now. This is my value choice. I expect and accept that others will disagree.

As a result of this value choice, I believe any bill that fails any one of these four tests is fiscally and economically irresponsible, and therefore worth defeating.

There does not have to be a tradeoff. A bill could go after the core policy drivers of health care cost growth, especially the tax exclusion for employer-provided health insurance, and replace it with incentives for individuals to shop for high-value health insurance and high-value health care. Such a bill could meet all of the above tests and significantly reduce the number of uninsured. I will describe such a bill in a future post. Such a bill is not going to be passed by this Congress.

I think the administration would agree with my test. They might define Test 3 to be a subset of Test 2. I think it’s important analytically to separate the two.

In practice the test gets slightly more complex. Test 1, “The bill does not increase the federal deficit in the short run,” breaks down into (1A) “over the next five years” and (1B) “over the next ten years.” The Congressional budget rules require that a bill not increase the federal deficit over the next five years. To his credit, the President and his advisors have also been emphasizing that it is important to meet the same test over the next ten years. From a formal legislative process standpoint, only the five-year window is formally binding, because Congress passed a 5-year budget plan (called a budget resolution). In particular, proponents of a bill will need 60 votes in the Senate for any bill that fails (1A). All other tests can be violated and passed with a simple majority.

I will apply this four-part test framework to each major legislative proposal considered by Congress. I want to begin today by walking briefly through each test.

Test 1: The bill does not increase the federal deficit in the short run.

I would like to make this test more stringent – my personal policy preference would be “The bill reduces the federal deficit in the short run,” especially given the path of expected budget deficits under the President’s budget. The actual test, “does not increase,” is the test in the Congressional budget resolution. It says that at a minimum, any new spending should be offset.

I would also like to make the test apply to federal spending, rather than just the federal budget deficit. I would almost certainly oppose a bill that increases government spending over the next ten years by a few hundred billion dollars, and offsets it with the same amount of tax increases. Again, I’m matching my test to the minimally binding one that Congress will apply to itself. This means that this test for me is one-way: any bill that fails it should be opposed, and some bills that pass it should still be opposed, because they dramatically increase the size of government. Still, for the purpose of this exercise I am applying the looser deficit-based short-term test.

By choosing a looser short-term test than I would prefer, I believe I accomplish two goals:

- This test conforms with the formal budget rules that will govern this bill (measured over a five year period).

- This test fits the “Blue Dog” / conservative Democrat / moderate Republican view of the world. I think I’m taking away an excuse for them to object to my four-part test.

Test 2: The bill reduces the federal deficit in the long run.

For each of these tests, I’m defining “long run” as more than ten years. That’s an arbitrary breakpoint.

While I’m willing to say I could swallow some bills that do not increase the short-term budget deficit, a bill must significantly reduce the long-run federal deficit to be fiscally responsible. Given that our long-term federal deficit path is unsustainable to the point of national economic collapse, and given that health care cost growth is one of the primary drivers of that deficit path, not making the problem worse is insufficient. A bill must result in dramatic reductions in future budget deficits to be fiscally responsible.

This test interacts with Test 3 in a somewhat subtle way. While Test 1 is a deficit test, the facts of our long-term budget problem mean that Test 2 is driven by Test 3, which is about government spending on health care.

Test 3: The bill significantly slows the growth of government health care spending in the long run.

Test 2 is about the long-term budget deficit. Test 3 is about long-term government spending on health care. The President and his budget director are correct when they identify unsustainable per capita health care spending as a primary driver of long-term deficits. (They are incorrect when they identify it as the primary driver of long-term deficits, and dismiss the importance of Social Security spending and aging of the population, as the President did yesterday. I will return to this point in a future post.)

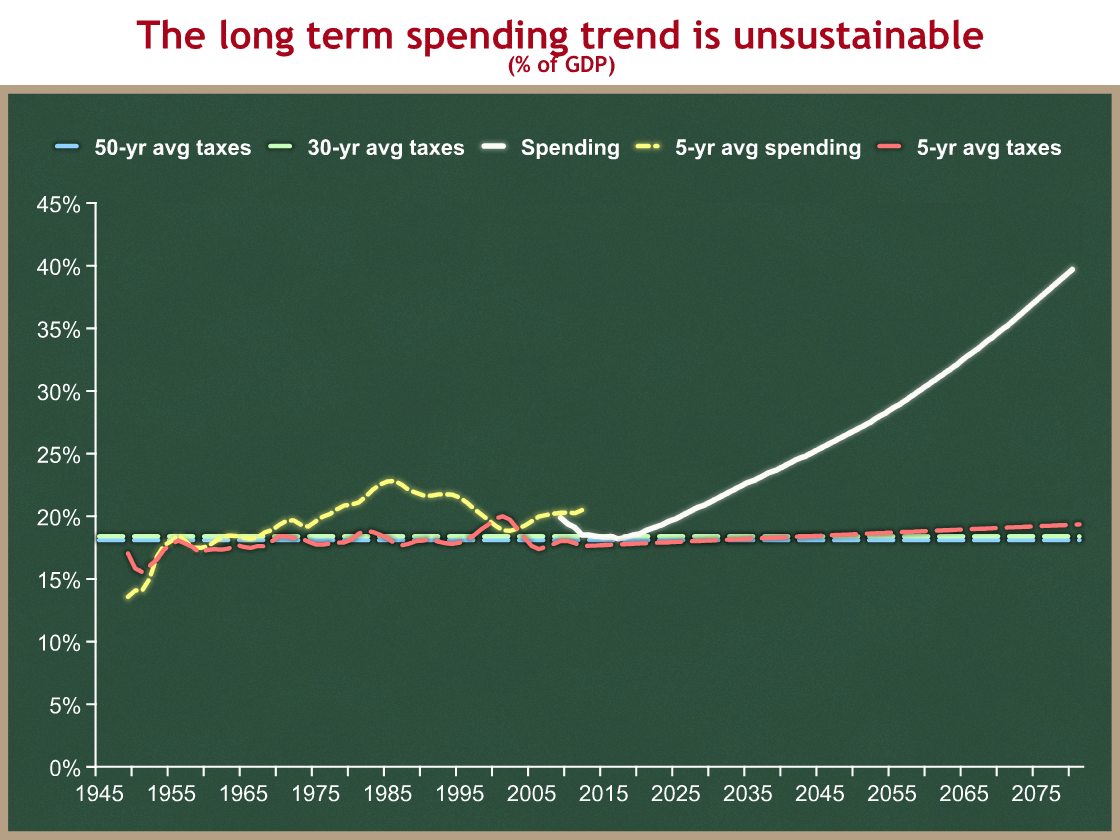

In mid-April I explained that America’s long-term budget problems are driven by unsustainable spending growth, and not by the level of taxation. I think it’s one of my most important posts. I hope you will find time to read it if you have not done so already. Here is the key graph:

On the above graph, the white line is federal spending, and the dotted lines are various tax policies. The expanding gap between the white line and the dotted lines is the federal budget deficit. You can see the gap (deficit) explodes as the spending line pulls away from the tax lines.

America’s long-term budget problems are driven entirely by the difference between the slope of the white spending line and the dotted tax lines. Over the long run, a constant tax policy always grows as fast as the economy, and so it remains flat on a graph that measures quantities as a share of the economy. So while we can and do debate about the level of the dotted tax lines, they’re always going to be flat.

You can see that any flat tax line cannot keep up with a rapidly growing upwardly sloped white spending line. Even if you were to rais the flat dotted line to 25% of GDP, you would still have a long-term deficit problem because of the slope of the spending line. The key to success is not just lowering federal spending, it’s tilting that white line dramatically downward. This is what the President and his budget director correctly mean when they say we need to bend the (government) cost curve downward. And they deserve praise for identifying federal health care spending as a major driver of that white line’s slope.

It is therefore odd and self-contradictory that they have proposed raising taxes to offset the higher spending of a new health care entitlement for the uninsured. While you can technically meet my short-term Test 1 by doing so (in a Blue Dog / centrist way that I would oppose, but you’d meet it), it is mathematically impossible in the long run to offset a new health care entitlement with higher taxes, unless your bill also slows the growth of health care spending in other ways.

To put it graphically:

- The new health care entitlement for those who are now uninsured would raise the level of the long-term white federal spending line.

- Even if you increase taxes, raising the dotted federal tax lines so that the deficit gap between spending and taxes over the next five or ten years does not increase (thus meeting my Test 1), in the long run the new health care spending will grow faster than the economy, while the new tax revenue stream will grow at the same rate as the economy. You will therefore be exacerbating the long-term deficit problem caused by the white spending line above.

- The only way to solve this is if you make other changes in the bill that bend downward the slope of the white line.

This last bullet is the President’s stated solution. In effect, he is saying, I’m OK raising long-term federal spending on a new health care entitlement, and thus raising the level of the white line in the long run, as long as we raise the dotted tax lines to offset it in the short-run, and as long as we make other changes to tilt that white line downward (or at least not upward so much.)

The President and his allies have a problem, in that their specific policy of expanding pre-paid health insurance to tens of millions of uninsured Americans will instead increase the slope of the white spending line. The academic evidence is clear that as third-party payment for health care increases, sensitivity to cost decreases and health care spending (total and governmental) increases. Creating a new entitlement for the uninsured helps the uninsured. But it worsens our long-term budget problem in two ways: it raises the level of the long-term spending line, and it increases its slope. Both exacerbate an already-devastating long-term federal budget picture.

So for the President to meet his stated goal, and to make any significant progress on our long-term budgetary problems, the rest of the bill must not only bend the spending line downward, it must do so by more than these two factors that raise the white line by creating a new health care entitlement. I think it’s a mistake to make your most serious problem worse before trying to solve it.

Test 4: The bill significantly slows the growth of private health care spending in the long run.

This is closely related to but separate from Test 3. I praise the President for correctly identifying society-wide health care cost growth as the problem to be solved, rather than just government health care cost growth or the number of uninsured. Private sector health care cost growth is what keeps the number of uninsured high, and it is what squeezes the wages and budgets of more than 200 million Americans with private health insurance. We must make policy changes that stop distorting behavior to encourage unsustainable cost growth in private sector health care.

As I said above, the expansion of third-party payment for the uninsured exacerbates this problem, as would any policy changes that might discourage people from moving to high-deductible plans, or discourage people from shopping for health insurance or medical care based on quality and price.

The President correctly identifies this problem. He admirably says it is a condition that must be met by health care legislation. Unfortunately, he has made no specific policy proposals that would achieve this goal. The President and his budget director emphasize policies that would provide private sector consumers with better information about the health care they use. They have proposed policies that would change government spending policies. They have proposed no policies that would change incentives for private consumers of health care. (I wrote about this in April.) Without such policies, you cannot meet Test 3 or Test 4. And without such policies, expanding government entitlement spending is horribly irresponsible in the long run.