Some have been arguing that the growth package should extend the availability of unemployment insurance (UI) benefits.

I’d like to cover three points in response:

- Unemployment benefits have never before been extended when the unemployment rate is as low as it is now, or before the economy has been in a recession.

- Extending unemployment benefits will not have a quicker positive effect on GDP growth than tax rebates.

- Extending unemployment insurance benefits encourages some workers to remain unemployed. This could hurt job growth and undo much or all of the near-term positive effects of the House-passed growth package.

Special thanks go to Dr. Edward Lazear and his team at the Council of Economic Advisers for the first and third points. p.s. Eddie is a labor economist.

Unemployment benefits have been extended seven times since the 1950s. Only twice have extended benefits started when the unemployment rate was below 7.0 percent. In both cases, the unemployment rate was above 5.7 percent. The current unemployment rate is 5.0 percent.

Unemployment benefits have never been extended before a recession. Almost all periods of extended benefits occurred after the conclusion of a recession. Twice extensions were initiated 12 months into a recession (1975 and 1982). And of course, our economy is now growing, albeit slowly.

Special Extended Benefit Programs

| Date | Unemployment rate |

| June 1958 | 7.3% |

| April 1961 | 7.0% |

| January 1972 | 5.8% |

| January 1975 | 8.1% |

| September 1982 | 10.1% |

| November 1991 | 7.0% |

| March 2002 | 5.7% |

Some (including, unfortunately, the Congressional Budget Office) have blurred the distinction between when UI and rebates begin, and when the actual increase in GDP would occur. The press has repeated the incorrect assertion that “unemployment benefits would affect the economy more rapidly than tax rebates.”

While UI checks would start sooner than rebate checks, the vast majority of the cash out the door, and therefore the GDP effect, would occur much earlier from rebate checks than from extending unemployment insurance.

The logic is quite simple.

- Remember that this is an extension of unemployment insurance, from 26 weeks to 52 weeks. That means you only see the financial effects of the policy change in your 27th week of unemployment.

- The first UI help is felt very quickly, within a few weeks — but it only affects people who are about to exhaust their unemployment benefits. For people who aren’t at 26 weeks yet, they won’t feel the effects till later.

- Hence, the stimulus effect of UI relief begins rapidly for a few, but it grows quite gradually — it gets drawn out over a longer time frame, as more people approach week 27.

- Sending people tax refund checks would start later but would peak quickly instead of being spread out over a longer time. We estimate checks would start about 60 days after enactment, and would be delivered over roughly a 7-week period.

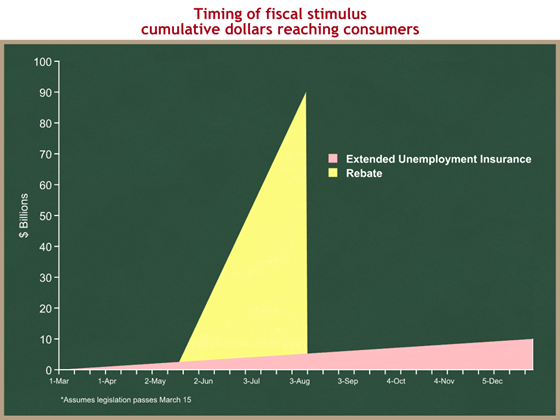

This graph shows the cumulative cash out the door, comparing rebate checks and unemployment insurance. The first thing to notice is the difference in magnitude — UI benefits affect fewer people than broad-based tax rebates, so the total amount of dollars going out the door is much smaller, and therefore the economic benefit is smaller.

But the main point is that, while UI benefits would begin in late March and rebate checks not until about mid-May, the checks are concentrated into about a 7-week window. Once that’s done (say, by the end of June), the whole $100B of rebate checks are out the door and into the economy. The UI benefits grow much more slowly, as people “age into” their extended benefits by hitting the 26-week threshold.

Under current law you’re eligible for 26 weeks of unemployment insurance. The most frequently discussed proposal is to extend that for another 26 weeks, to a full year.

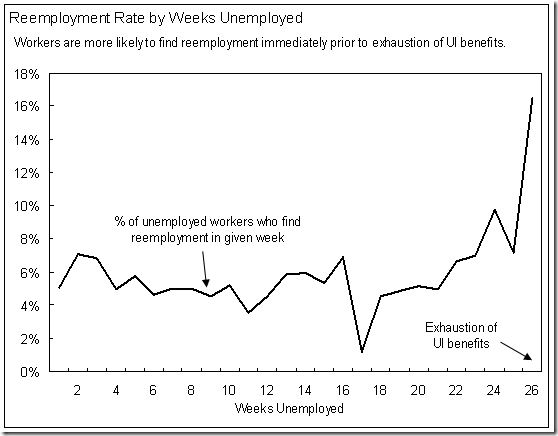

Some find it implausible to suggest that some people would choose to remain unemployed because they don’t want to lose their unemployment insurance. But the numbers don’t lie. Look at the dramatic increase in the percentage of workers who find a job in week 26, right before their UI benefits run out.

In fact, according to two economists from the Clinton Administration, extending UI benefits by 13 weeks increases the duration of the typical spell of unemployment by one to two weeks. (Card and Levine, 2000; Katz and Meyer 1990)

So if you extend UI benefits, you will increase the duration of the typical spell of unemployment. Fewer people will have jobs, and economic growth will be slower. While we’re reticent to put an exact number on this effect, the numbers are significant enough that it could counteract much of the benefits of the House-passed growth package.